|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

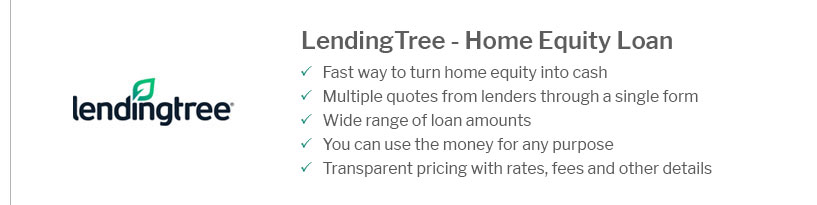

Understanding the Benefits of Conventional Loan RefinanceRefinancing a conventional loan can be an excellent way to improve your financial situation. Whether you're looking to lower your interest rate, reduce your monthly payments, or change the loan term, understanding the ins and outs of refinancing can help you make an informed decision. Reasons to Consider RefinancingLower Interest RatesOne of the primary reasons homeowners refinance is to secure a lower interest rate. A reduced rate can lead to significant savings over the life of the loan. Change Loan TermsRefinancing allows you to change the term of your loan. You can opt for a shorter term to pay off your mortgage faster or extend the term for lower monthly payments. Access Home EquityThrough refinancing, homeowners can tap into their home equity. This can be particularly beneficial if you need funds for major expenses or want to refinance home equity loan bad credit for better terms. Steps to Refinance a Conventional Loan

Potential Drawbacks

Frequently Asked QuestionsWhat is the typical cost of refinancing a conventional loan?Refinancing costs generally range from 2% to 5% of the loan amount, including application fees, appraisal fees, and closing costs. How does my credit score affect refinancing?A higher credit score usually qualifies you for better interest rates and terms. It's advisable to check your credit report before applying. Can I refinance if my home value has decreased?It may be more challenging to refinance if your home value has dropped, as lenders look at your loan-to-value ratio. However, some programs might still offer options. https://www.pennymac.com/refinancing-products/conventional-refinance

A conventional refinance is the process of obtaining a new conventional mortgage in order to pay off and eliminate the previous loan that you had on your home. https://www.compmort.com/conventional-refinance/

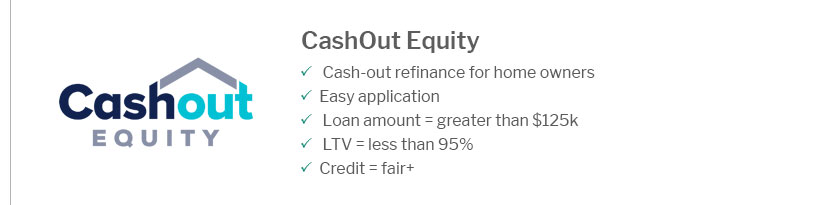

Conventional Refinance Requirements - Credit score of 620 or higher. (A higher credit score often results in a better interest rate.) - Debt-to-income ratio ( ... https://www.usbank.com/home-loans/refinance/conventional-fixed-rate-refinance.html

A conventional fixed-rate refinance has an interest rate that won't change for the life of your home loan, making your monthly principal and interest payment ...

|

|---|